In today’s world, where medical advancements are at an all-time high, the risk of being diagnosed with a critical illness remains a significant concern. With the rising costs of healthcare, being financially prepared is more important than ever. This is where critical illness insurance comes into play, serving as a vital component of a comprehensive financial plan.

What is Critical Illness Insurance?

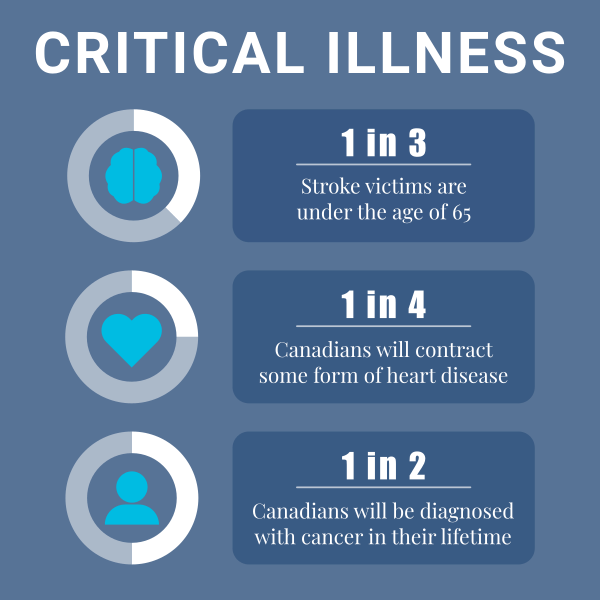

Critical illness insurance is a type of policy designed to provide financial support upon the diagnosis of specific life-threatening conditions. These can include, but are not limited to, cancer, heart attack, stroke, kidney failure, and major organ transplants. The policy pays out a lump sum amount, which policyholders can use to cover medical expenses, supplement lost income, or address other financial needs during treatment and recovery.

Why is Critical Illness Insurance Important?

- Financial Security: A critical illness can lead to significant medical expenses and loss of income. The lump sum payout from a critical illness insurance policy can help bridge the gap, ensuring you and your family remain financially stable.

- Focus on Recovery: With financial worries alleviated, patients can focus on their recovery and well-being. The peace of mind that comes from knowing you have financial support can positively impact your mental and physical health.

- Coverage for Costly Treatments: Advanced medical treatments for critical illnesses can be expensive and may not be fully covered by health insurance. Critical illness insurance can help cover these additional costs, allowing access to the best possible care.

- Flexibility in Use: Unlike health insurance, which often has restrictions on how funds can be used, critical illness insurance provides a lump sum that can be used at the policyholder’s discretion. Whether it’s paying for experimental treatments, household expenses, or making necessary lifestyle adjustments, the choice is yours.

- Supplementing Health Insurance: Health insurance is essential, but it may not cover all expenses associated with a critical illness. Critical illness insurance acts as a supplementary policy, providing an extra layer of protection.

Who Should Consider Critical Illness Insurance?

While critical illness insurance can be beneficial for anyone, it is particularly important for those with a family history of critical illnesses, individuals in high-stress jobs, or those with financial dependents. It is also advisable for people who are self-employed or whose jobs do not offer comprehensive health benefits.

Conclusion

Critical illness insurance is a crucial element of a robust financial plan, offering protection against the unforeseen and often overwhelming challenges posed by serious health conditions. By investing in this type of insurance, you can ensure that you and your loved ones are financially secure, allowing you to focus on what truly matters—your health and recovery. As with any insurance product, it’s important to thoroughly research and choose a policy that aligns with your individual needs and circumstances.

Leave a Reply